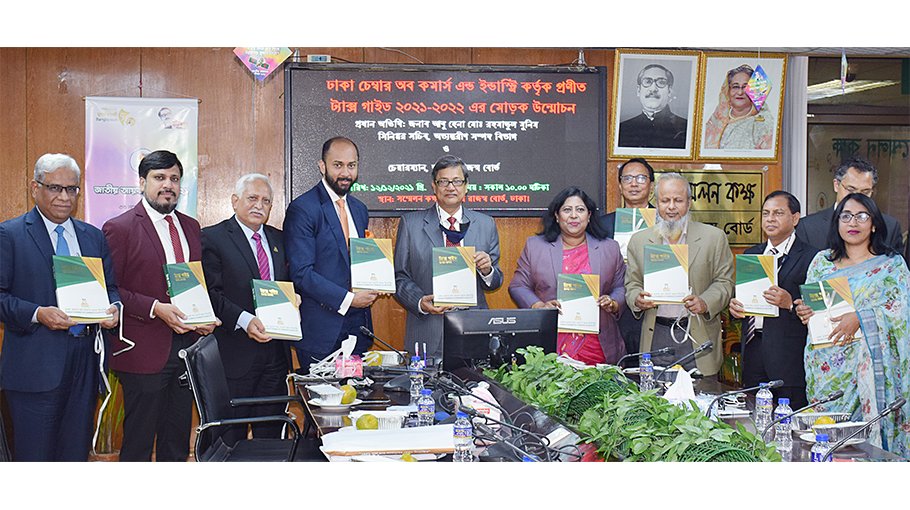

NBR works relentlessly to ensure business friendly tax eco-system

NBR Chief says while unveiling “DCCI Tax Guide 2021-22”

NBR is relentlessly working to ease overall taxation system, tax structure, ensure business friendly tax eco-system, ensuring quality service and tax automation, said NBR Chairman Abu Hena Md. Rahmatul Muneem on Sunday.

He said the more the tax structure will be user friendly, the more people will be encouraged to pay tax, he said.

The Chairman of National Board of Revenue (NBR) was addressing cover unveiling ceremony of “Tax Guide 2021-22”, published by the Dhaka Chamber of Commerce & Industry (DCCI) in a ceremony at the NBR head office, Kakrail in the capital.He also said that NBR regularly sits with the trade organizations including Dhaka Chamber before preparing budget and NBR always tried to considers recommendations placed from DCCI.

“A few working committee on technical, research and business aspects may be formed comprising with the representatives from concerned stakeholders and NBR for the overall development of revenue structure”, he added.

He further underscored the importance of capacity development of NBR and for that he said that NBR needs more skilled manpower to meet the growing demand of rapid economic development.

DCCI President Rizwan Rahman, while addressing, said that the tax policy should be simplified and easy so that mass people and business community can be encouraged to

pay tax.

DCCI is happy to work with the NBR hand in hand to create a tax friendly environment in the country and this effort will be continued in future, Rizwan Rahman said.

He welcomed the NBR Chief for taking a bold initiative of upgrading the age-old Tax Law with a view to explore more trade and investment opportunities.

He hoped that the upcoming new Tax Law will soon come into effect and will help create a better business friendly environment in the country both for local and foreign investors. A business friendly, simplified and timely tax law will expedite local as well as foreign direct investment,

he said.

Read more: BEPZA, NBR sign MoU to expedite customs-related services

Private sector contributes 80% of the total GDP and to strengthen the private sector, it is necessary to facilitate them with adequate policy support, he added. In order to encourage the members of the Chamber, DCCI regularly publishes Tax Guide and distributes to its all members free of cost.

Members of NBR, DCCI Senior Vice President N K A Mobin, FCS, FCA and Vice President Monowar Hossain were also present on the occasion.