Huge response for Universal Pension Scheme

Universal pension scheme (UPS) has been getting a good response from people within its first four days of inauguration.

An official of the Finance Ministry said a total of more than 50,000 people had registered in the Universal pension scheme during the last four days till 8 pm on Sunday.

In the meantime, 5500 people have deposited the first installment of their pension. The total amount was about Tk2.75 crore, he added.

Golam Mostafa, Additional Secretary of the Ministry of Finance and member of the National Pension Authority, said, “People are getting a good response for taking pension. 5,475 people submitted subscriptions till 4:30 pm on Sunday. The amount of accumulated subscription is around Tk 2.75 crore.”

Another official said that the number of applicants is not a big deal. Rather, how many people have accepted pension benefits or schemes is the big thing, he added.

The government launched the universal pension scheme for the first time in the country on Thursday to protect the 85 percent people of the society engaged in the low income and informal sector.

Prime Minister Sheikh Hasina inaugurated the much-talked-about Universal Pension Scheme to bring all the people of the country aged above 18 under the scheme, so that they can enjoy a lifetime pension facility after age 60, on 17 August.

The scheme initially targeted four categories – private sector employees, non-resident Bangladeshis, individuals from the informal sector, and insolvent individuals. Individuals from various professions, such as rickshaw pullers, domestic workers, street vendors, and hawkers, will be included in the informal sector.

All Bangladeshi citizens aged 18 to 50 years can participate in this scheme.

Monthly subscription can be minimum Tk 500 and maximum up to Tk 10,000.

However, there is an opportunity to change the programme and increase the amount of subscription.

According to the scheme, the contributor will get a monthly pension if he or she contributes continuously for at least 10 years.

The pension will be paid against the deposits with the accumulated profits in the pension fund on the completion of the age of 60 years of the contributor. Bangladeshi workers working abroad can participate in this programme.

It is also said that the government can give a portion of the monthly contribution to the pension fund as a grant to the citizens below the lower income limit, or in case of indigent contributors.

According to the bill, a pensioner will get pension benefits for a lifetime. However, if he or she dies before completing 75 years while on pension, his nominee will be entitled to a monthly pension for the remaining period (up to the age of 75 years of the original pensioner). If the subscriber dies at least 10 years before the subscription is made, the deposited money will be returned to his nominee along with the profit.

If the money deposited in the pension fund needs to be withdrawn at any stage, the subscriber can withdraw a maximum of 50 percent of the deposited money as a loan, which has to be paid with fees. The bill also states that the money received from the pension will be exempt from income tax and the contributions earmarked for the pension will be treated as investments and will be considered for tax deduction.

The rules under the Universal Pension Management Act-2023 are called the Universal Pension Scheme Rules, which will come into force immediately.

Details of the scheme are given under Section 3 of the Rules.

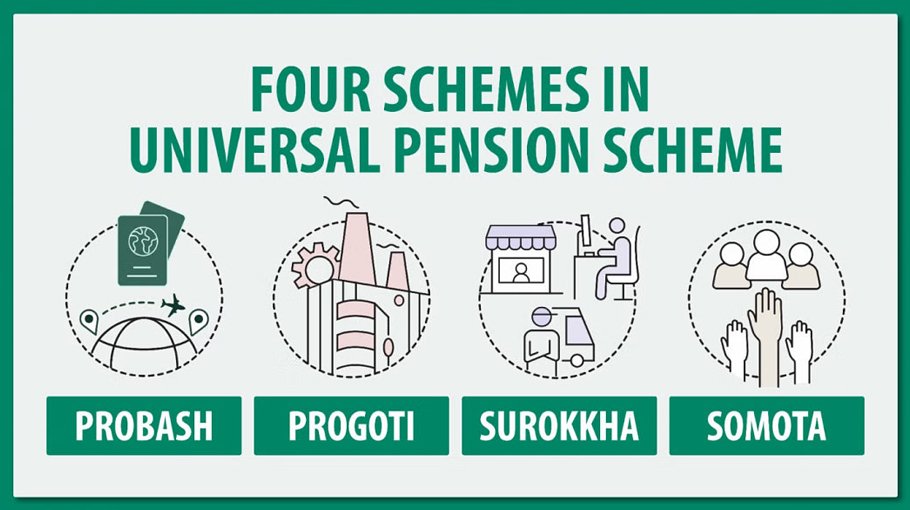

Prabashi Scheme (for expatriate Bangladeshi citizens): Any Bangladeshi working or staying abroad can participate in this scheme by paying a monthly subscription of Tk 5,000, 7,500 and 10,000 in foreign currency. The expatriate can pay the equivalent amount in local currency after returning home. They can change the scheme if necessary. However, the pensioner will be entitled to pension in local currency on completion of the pension scheme.

Pragati Scheme (for employees of private organizations): An employee working in a private organization or an owner of an organization can participate in this scheme by paying a monthly contribution of Tk 2,000, 3,000 and 5,000.

In case of participation of employees of private organizations in this scheme, 50 percent of the scheme contribution will be paid by the employee and the remaining 50 percent by the organization. If a private organization does not participate in this scheme institutionally, any employee working in that private organization can participate in this scheme on his own initiative.

Surokkha Scheme (for Self Employed Citizens): Tk 1,000, Tk 2,000, Tk 3,000 and Tk 5,000 per month for persons working in the informal sector or self employed such as farmers, rickshaw pullers, laborers, blacksmiths, potters, fishermen, weavers and so on.

Samata Scheme (contributory pension for self-employed low-income citizens): Low-income persons living below the poverty line (whose current life expectancy is below Tk 60,000 per annum) on the basis of the life expectancy published by the Bangladesh Bureau of Statistics (BBS) from time to time can participate this scheme by contributing Tk 1,000. Out of Tk 1,000, the contributor’s share will be Tk 500 and the government's share will be Tk 500.