How to Buy Prize Bond

What is a Prize Bond:

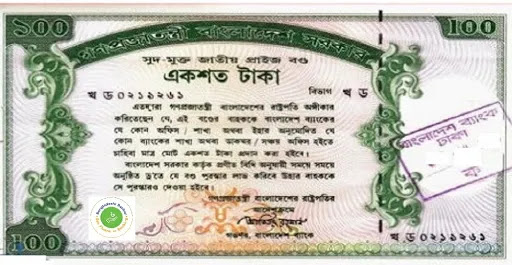

The Prize Bond, a public savings plan, was established by the Bangladesh government in 1974 with the purpose of pooling local resources and providing incentives to small savers. The holders are recognised as the bond's owners because the bonds generated under this scheme are 'bearer' in nature. These bonds are actually government debt, and Bangladesh Bank manages the entire plan on the government's behalf.

Why prize bond:

Risk-free:

Prize bonds are risk-free, government-backed investment that gives you the chance to win large cash awards. Tk 100 is the minimum purchase amount for prize bonds.

- Quarterly Draw:

Every quarter, on January 31, April 30, July 31, and October 31, the prize draw is held. Every draw currently has 2,944 cash prizes.

- Confidentiality:

Winnings from prize bonds are kept private. Prize bond recipients' names are not published, and they are not divulged to anyone other than the winner. You can look up your winning numbers in the newspaper or on the website that publishes the lottery results. The winning numbers can be found on the Bangladesh Bank's website. The winning numbers are published in national publications and are also available in Bangladesh Bank.

- Cash anytime:

Prize Bonds can be cashed at any time.

- Investments:

Prize bonds are a state-guaranteed, flexible, and safe investment. Every three months, you have the chance to win rewards (up to Tk 600,000 per unit). That's a significant return on your investment with a minimum purchase of Tk 100. Every three months, there are around 2,944 awards ranging from Tk 10,000 to Tk 600,000. No matter how old a Prize bond is, it is automatically put into the quarterly draw. The more Prize bonds you own, the more likely you are to obtain a good return on your investment.

- Gifts:

Consider how many times you've wracked your brain for a gift idea. The answer is prize bonds. Every three months, with a minimum purchase of Tk 100, you can give someone the chance to win one of the 2,944 prizes ranging from Tk 10,000 to Tk 600,000. You're not only getting reward bonds; you're also getting the opportunity to win cash prizes for years to come. Not only that, but prize bonds are also an excellent way to get someone started in investing. Prize bonds can continue to win as long as they are retained. The entire capital worth is readily available for withdrawal at any time. That's the kind of gift that keeps on giving.

Read More: Bangladesh Bank suspends interest on bank loans

How to buy prize bond in Bangladesh:

Any Bangladeshi, including minors, can purchase bonds in any quantity. Only Prize bonds with an issuance date of at least 60 days before the draw date are eligible for the draw. The bonds are available for purchase from Bangladesh Bank offices, approved commercial and specialized bank branches, the National Saving Bureau, and post offices.

How to claim the prize:

To claim the reward, fill out an application form, which can be found at any bank or post office. You should write to the General Manager of the Bangladesh Bank branch in question. The validity period for claiming a reward following a draw is two years. There are around 26 series, each with 1,000,000 reward bonds. If a prize bond number is chosen, all prize bonds in that series are also chosen. Prize bonds have no interest attached to them. Prizes of around Tk 42 crores are currently awarded to approximately 11,800 winners each year.

Read More: Draw of Tk 100 prize bond held

Ending remarks:

Prize bonds, issued by the Bangladeshi government to mobilize domestic resources and provide incentives to small savers, are a popular type of investment among the general public. Prize money on Prize Bonds was tax-free until 2011, when the government imposed a 20% income tax on the prize money.

If you liked this article, then please subscribe to Bangladesh Post YouTube channel for latest news. You can also find us on Twitter and Facebook.