Canada sheds jobs in March, increasing bets for June rate cut

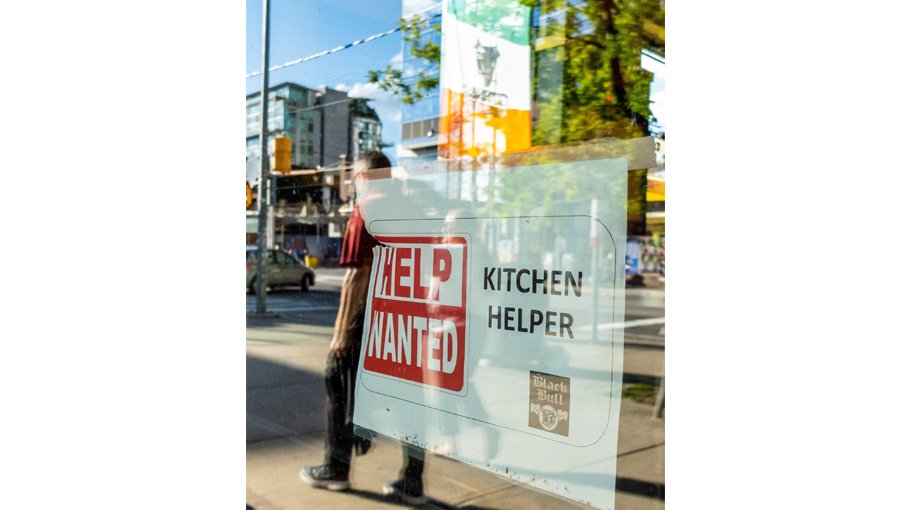

Canada's economy unexpectedly shed a net 2,200 jobs in March, largely in the services sector, while the jobless rate increased to a new 26-month high of 6.1 per cent, data showed on Friday.

The weak jobs data spurred money markets to increase their bets for a June rate cut, although they still expect a hold

from the Bank of Canada (BoC) at its next announcement on Wednesday.

Analysts polled by Reuters had forecast a net gain of 25,000 jobs and the unemployment rate to rise to 5.9 per cent from 5.8 per cent in February.

With the 0.3 per cent percentage point rise - the biggest jump since August 2022 - the unemployment rate is the highest since the 6.5 per cent recorded in January 2022. Before the COVID-19 pandemic, Canada's jobless rate was last as high as 6.1 per cent, in November 2017.

The average hourly wage growth of permanent employees, however, accelerated to an annual rate of 5.0 per cent from 4.9 per cent in February, Statistics Canada said.

The growth rate of wages - closely tracked by the central bank because of its effect on inflation - accelerated for the first time in three months.

South of the country's border, US jobs data came at the same time as Canada and surprised to the upside, adding 303,000 jobs in March against a forecast of 200,000 jobs, signalling continued economic strength in the country.

Analysts and economists have said that the BoC is likely to lead the Fed in rate cuts since, despite some recent strong numbers on the GDP front, the US economy has been showing signs of weakness and inflation has cooled considerably.

"While markets had been pushing back expectations for a first Bank of Canada interest rate cut following strong GDP data to start the year, today's labor force data should see them pulling those expectations forward," Andrew Grantham, senior economist at CIBC, wrote in a note.

Money markets increased their bets for a rate cut in June to close to a 76 per cent probability from 67 per cent before the numbers were released.

The Canadian dollar extended losses to trade 0.58 per cent lower at 1.3620 to the US dollar, or 73.42 US cents, at 1240 GMT. The two-year government bond yields fell by 2 basis points to 4.164 per cent.

The BoC has repeatedly stressed that it would only start considering reducing borrowing costs when it is sufficiently certain that inflation was on its path to meet the bank's 2 per cent target.

"Today’s evident weakening in the labor market only makes it tougher for policymakers to uphold a wait-and-see attitude, and this really opens the door for a strong dovish pivot by the BoC that hints toward a rate cut in June," said Kyle Chapman, FX Markets Analyst at Ballinger Group.