Budget to accelerate dev

With a view to accelerating further the ongoing development programme, the government of Prime Minter Sheikh Hasina put forward a big and ambitious budget. Setting 8.2 percent GDP growth target for the FY20, touching double digit landmark by FY24 for laying a solid foundation of a high-income country till 2041, the Finance Minister A.H.M Mustafa Kamal has unveiled a mega Tk 523,190 crore budget.

With the theme, ‘Bangladesh on a Pathway to Prosperity: Time is Ours, Time for Bangladesh,’ the finance minister has set a number of welfare-oriented initiatives in his budget plan for the coming year.

Besides, he proposed reforms in the banking sector, capital market, savings certificates and social safety net programmes and generate employments. The inflation rate during the coming fiscal year has been projected at 5.5 percent. For financing the budget, the government has set a target for the National Board of Revenue (NBR) to collect Tk 325,600 crore in 2019-20 while the government’s entire revenue collection outlay is set at Tk 377,810 crore.

For implementing numerous numbers of development projects in the coming year, the government has estimated Tk 202,721 crore allocation under its annual development programme (ADP). For speedy implementation of the development projects under ADP, Tk 130,921 crore will be mobilized from internal sources, while the rest of Tk 71,800 crore has been planned to receive from external sources. 209.

“A large part of total budget expenditure is financed from the internal resources collected by the NBR. Generally, the internal revenue collection target is made on the basis of the size of the budget,” the finance minister said. The overall budget deficit will be Tk 145,380 crore, which is 5 percent of GDP. In financing the deficit, Tk 68,016 crore will come from external sources and Tk 77,363 crore from domestic sources.

Amongst the financing from domestic sources, Tk. 47,364 crore will come from the banking system and Tk 30,000 crore from savings certificates and other non-bank sources. Apart from NBR tax, the non-NBR tax revenue target for the FY20 is Tk 14,500 crore while the non-tax revenue target is Tk 37,710 crore.

As per this estimation, the NBR will have to collect revenue with a growth rate of 16.28 percent in comparison with the revised revenue collection target in the current fiscal that is Tk 280,000 crore. President M Abdul Hamid earlier authenticated the national budget for 2019-20 fiscal and the revised budget for 2018-19 for placing before the Jatiya Sangsad by finance minister.

The head of the state authenticated the budget at his secretariat at the Jatiya Sangsad Bhaban at 3:10pm. The cabinet in its special meeting approved the proposed budget for fiscal 2019-20. Prime Minister Sheikh Hasina presided over the meeting held in the cabinet room of the Jatiya Sangsad Bhaban on the day.

The cabinet also endorsed the Appropriation (supplementary) Bill- 2019, and the Appropriation Bill-2019. Finance Minister AHM Mustafa Kamal and other cabinet ministers and state ministers concerned attended the meeting. The finance minister has placed his maiden budget, also the first of this government after assuming to power through the general election on December 30, 2019.

In his speech, the minister mentioned that Bangladesh is well poised to celebrate the golden jubilee of its glorious independence and the 100th birth anniversary of the Father of the Nation Bangabandhu Sheikh Mujibur Rahman, which is a rare occasion in the national history. “We are committed to the nation to realize fully the Vision 2021 and implement the agenda for 2030 for building a happy and prosperous future for the nation, and thus materialize the Father of the Nation’s cherished dream of establishing Sonar Bangla (Golden Bengal), which is the fundamental premise of our current election manifesto too,” he said.

Paying profound tribute and deepest gratitude to the Father of the Nation Bangabandhu Sheikh Mujibur Rahman, the man with colourful political personality, the possessor of a magical voice, the greatest Bengalee of all times and the architect of independent Bangladesh, the minister remembered with respect all the martyrs of the fateful night of August 1975 and to the four most competent comrades of the Father of the Nation who were killed in jail, thirty lakh martyrs in the war of liberation, all the valiant freedom fighters and two lakh women who were brutally persecuted during the war.

The finance minister proposed to raise the tax-GDP ratio to 15 percent in two years from present 10 percent and for this effective initiatives have already been taken to expand the Income Tax Department and set up tax offices in every upazila and raise the number of taxes zone to 63 from existing 31.

For making the tax administration more goal-oriented, job-oriented and taxpayer-friendly, the tax intelligence, investigation and enforcement unit; digital tax management unit; tax deduction management unit; tax information unit; international tax unit; taxpayer service, public relations and infrastructure unit; and tax dispute resolution unit will be set up.

With successful implementation of these initiatives, he expected that the revenue will increase by 25 percent, and the Tax-GDP ratio will increase to 15 percent by 2021. The finance minister has proposed cash incentive of 5 per cent, with allocation of additional Tk 2,825 crore, for the readymade garments industry. At present, only four sectors of RMG are getting 4 percent cash incentive for exports to non-traditional markets, while 1 percent to the rest of the sectors of ready-made garments.

The tax-free dividend income for share individual investors to proposed to rise to Tk 50,000 from Tk 25,000 as what the minister said he wants to encourage small investors for strengthening the capital market. The minister has proposed allocation of Tk 1,43,429 crore, 27.41 percent of total allocation for social infrastructure sector, in which allocation for human resource like education, health and other related sectors is Tk 1,29,056 crore.

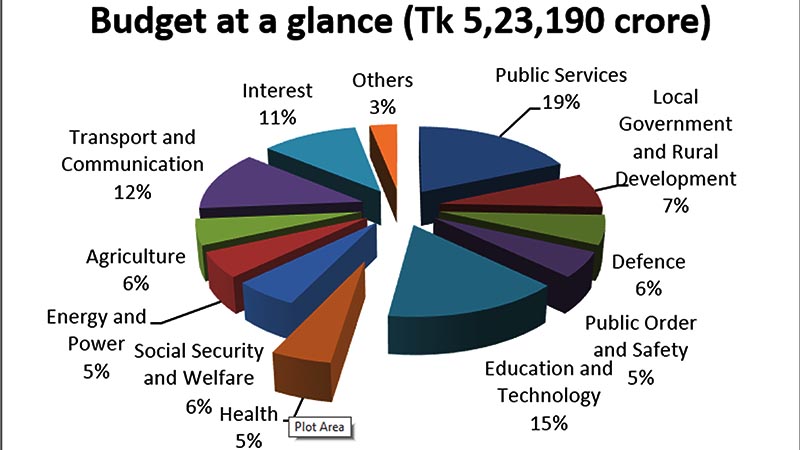

Allocation proposed for the physical infrastructure sector is Tk 164,603 crore, in which Tk. 66,234 crore will go to overall agricultural and rural development, Tk. 61,360 crore to overall communications, and Tk. 28,051 crore to power and energy. Total Tk 123,641 crore has been proposed for general services, Tk. 33,202 crore for public-private partnerships (PPP), financial assistance to different industries, subsidies and equity investments in nationalized corporations, banks, and financial institutions, which is 6.35 percent of total allocation.

Tk 57,070 crore has been earmarked for interest payment, Tk. 1,245 crore for net lending and other expenses. To reduce poverty, generate employment, and attract foreign investment, the government will enhance competitiveness of all business sectors including agriculture, industry, commerce, exports, real estate and services sectors.

Bringing the marginal people into the mainstream of development, special measures will be adopted for small and medium enterprises, and steps will be taken to reduce income inequality, he said. The main thrust of the coming fiscal’s budget is to create an investment-friendly environment for the private sector, expand export trade, ensure business-friendly tax management, bring about required reforms in the financial sector, and increase public sector investment to take our GDP growth to a higher trajectory, he said.

“We are aiming to achieve double digit growth soon through timely implementation of all nationally important infrastructure projects including mega projects such as the Padma Bridge, Padma Rail Link Project, Dohajari-Cox's Bazar rail line, Rooppur Nuclear Power Plant, Rampal Power Plant, Payra Sea Port, Matarbari Power Plant at Moheshkhali, and Dhaka Metro Rail, etc,” he further said.

To keep pace with transition to the Fourth Industrial Revolution, Bangladesh will have to prepare to remain at par with the rest of the world. For this, the classrooms will have to be subject-specific where Nano Technology, Bio-technology, Robotics, Artificial Intelligence, Material Science, Internet of Things, Quantum Computing, Block Chain Technology and other similar technologies will be taught, announced the minister.

The finance minister proposed an allocation of a total of Tk. 24,040 crore for the primary education sector, which was Tk. 20,521 crore in the budget for current FY2018-19. The government has allocated Tk. 9,000 crore in FY2019-20 for development projects in the secondary and higher education sector, which is 54 percent higher than that in FY 2018-19.

The minister proposed an allocation of Tk 29,624 crore for the secondary and higher education sector, which was Tk. 25,866 crore in the current fiscal year. He proposed to allocate Tk. 7,454 crore in FY 2019-20 for technical and madrasa education, which was Tk. 5,758 crore in FY2018-19. Considering that 28 ministries and divisions are implementing programmes related to education and training, the allocation for this purpose is Tk. 87,620 crore. This is the country’s 48th national budget and 20th by the Awami League government in its five terms since the 1971 Independence.