Growth of Islamic finance and banking

Islamic finance is an ethical standard for investment without “Riba” or interest and with prohibition on any deliberate investment to businesses or companies that are engaged in any form of gambling and manufacturing of porcine food items or alcoholic beverages. Islamic banking abides by the same principles as any Islamic financial system dictates with adherence to one of the fundamentals of Islam, a sense of cooperation out of piety and goodness of heart dismissing malice or evil.

Islamic finance is a way of managing money, based on the principles of Islam. It involves activities such as savings, investing and financing for sovereigns, corporates, and retail customers. These principles and the overall code of conduct in Islam are known as “Shariah”; which are adhered by over 1.9 billion people in the world. At the core of Islamic finance, or Shariah-compliant finance, is the belief that money has no intrinsic value; it is only a medium of exchange used to buy and sell goods and services that do have value. This has an important impact not only on how we think about banking and finance, but also the way we do business

The aim of Islamic banking and finance is to put an end to exploitation and form an equitable society by introducing the practice of Shariah Islamic law to govern the day-to-day operations of banks and different financial institutions. Islamic banks are directed by the boards of religious Shariah scholars to ensure Sharia’h compliance. Clients and practitioners are not essentially required to be Muslim, but all of them must respect the ethical structures imposed by Islamic values.

Conventional banking has the same purpose as Islamic banking does except the latter being subject to be compliant with the Shariah and operated under the guidelines of Fiqh al-Muamalat, the set of Islamic rules that govern commercial/financial transactions. Many of the Islamic banking principles are customarily accepted everywhere in the world throughout centuries.

Read more: Global Islami Bank opens 2 sub-branches

The Quran and the Sunnah, the known sayings, and practices by the Prophet Muhammad (Peace Be Upon Him), are the primary sources of the Shariah law. Ijma' or Consensus, the independent reasoning and opinions from a group of learned scholars based on the teachings of the Quran, is another practice of making rulings, which is followed only when the solution to a particular problem cannot be determined from the teachings of the Quran and the Sunnah.

The Muslim world practised Islamic banking and finance in the Middle Ages to foster their business and trades. Muslim merchants were the key middlemen for commercial and trading activities in Spain and the Baltic and Mediterranean countries. Claims are there that European businessmen and financiers later adopted many of the concepts, instruments, and techniques from Islamic finance.

Basic Principles of Islamic Banking

• The Shariah strongly prohibits the acceptance and payment of charges against the lending of money (‘riba’ as defined by Islamic scholars includes any excess out of a financial deal, interest, or usury) on any specific term or condition as well as investing money in a business that supply goods or provide services deemed contrary to its basic principles (‘Haram’).

• These principles have a universal nature which is present in non-Muslim literature too. Both the New and the Old Testaments of the Bible prohibit usury. William Shakespeare along with many 19th century writers criticized the ruthlessness of this particular practice. A considerable share of the morality upheld by Dickens and other Victorian writers includes everything from the non-partisan and fair distribution of wealth to the fundamental right of humans to work and still exists in the Islamic society in modern times.

• Despite the western media’s circulation of the fact that the present form of Islamic banking is a recent phenomenon, the basic principles behind these practices date back to the beginning of the 7th century.

• “Prohibition of Riba” from any form of investment, deposit, and transaction is the key principle of Shariah based banking or Islamic banking.

• Islam prohibits any interest-bearing deal and investment made in unlawful activities which are in the eyes of Islam harmful to the society. Islam also prohibits transactions that involve gambling or ‘maysir’ in any form and excessive uncertainty or ‘gharar’.

• Some salient features of this order can be summed up like this: Islam offers clear explanations to distinguish the ‘halal’ (lawful) from ‘haram’ (unlawful or forbidden) with reference to that economic activity. Broadly speaking, Islam forbids activities and intentions of all forms that are socially and morally injurious. Islam acknowledges an individual’s right to acquire and own wealth legitimately. At the same time, individuals must ensure the judicious use of their money and avoid squandering, hoarding, or putting it to no use.

• Islam allows individuals to retain surplus wealth and at the same seeks to keep the margin of that surplus in check for the welfare of the whole community, particularly for the deprived and destitute population by encouraging the capable sections of the community to participate in Zakat (the calculated tax on one’s wealth that is distributed to those who need). Islamic laws of inheritance discourage the availability and accumulation of wealth in the hands of a few to prevent the detriment of the whole society. The economic system ideated by Islam is a whole process that seeks to establish social justice without allowing any enterprise to transcend, so it gets to become individually self-destructive and collectively injurious. Islam has introduced a unique theory on the ownership, theme, and distribution of wealth, and associated social relationship. Islam enjoins individuals to not create or accumulate wealth for its own sake.

• The theme upon which the dispensation of wealth in Islam is carried out is accepted as an in-depth moral observation of the self and the society. Islam provides precise injunctions from a moral point of view as to which kind of wealth is acceptable and which is not; so that the way individual preferences on the accumulation of wealth can be utilised without going beyond the social meaning. At the ends, profits or returns are important. However, as the means, the way profits are made are considered more important. The emphasis in Islam on the economic prosperity of the society is, in fact, the reason for an emphasis on fair transactions in compliance with the Shariah.

Islamic finance products and services fall under either: Islamic banking, Islamic capital markets or, Takaful (Islamic insurance). Islamic financing takes place through asset-backed financing; all forms of financing have an asset involved in the transaction through either selling, investing, leasing or developing an asset. Financing is never done through cash for cash. Some of the common financing contracts are: (i) Murabahah (cost-plus financing): a sale of an asset with an agreed mark-up against an instant or deferred payment. (ii) Musharakah (joint venture): a commercial enterprise where all parties provide capital and share any profit and loss. (iii) Mudarabah (Profit and loss sharing): a contract between two or more parties where capital is provided by one party and the management and labour is carried about by the other partner. Profit is shared between at an agreed profit share. (iv) Ijarah (Leasing): a contract which involves the leasing of an asset for an agreed rental over a predetermined time.

Read more: Islami Bank holds 38th AGM

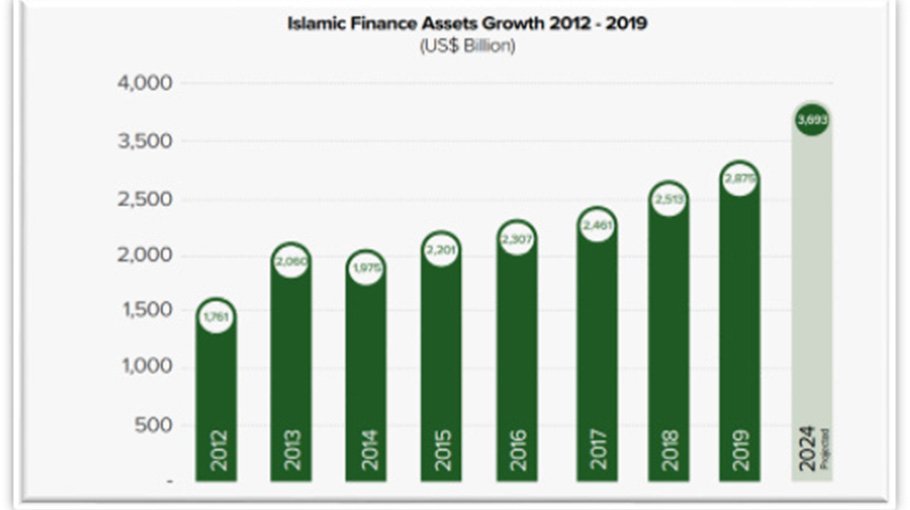

Islamic Finance has kept pace with the rapid changes in the market, adopting fintech and digital banking, while companies and governments are increasingly issuing sukuk (Islamic financial bonds), namely green sukuk. Yet while fintech is taking Islamic finance to the next level, recent growth is still solidly based on conventional banking services and products. The Islamic finance industry was estimated to be worth $2.8 trillion and forecast to reach $3.6 trillion by 2024. Malaysia, Bahrain and UAE remain the top countries for Islamic Finance globally.

Another area of growth in Islamic Finance is the increasing trend and convergence with Sustainable Development Goals (SDGs), ESG (Environment, Social and Governance), ethical, and impact finance. Shariah compliant products are screened to avoid prohibited industries, a practice that closely parallels ESG investing. Like investors in Shariah compliant products, investors using ESG screening strategies avoid certain activities and products so that their portfolios align with the values of the beneficiaries and clients, align with the goal of developing a sustainable and fair society, and do no harm to people or damage to the environment.

Md. Touhidul Alam Khan is Additional Managing Director & Chief Risk Officer of Standard Bank Limited (a Shariah based Islami Bank in Bangladesh). He is also fellow member of Institute of Cost & Management Accountants of Bangladesh (ICMAB).