Create better access to finance for venture capitals, startups

Speakers at a discussion urge the central bank

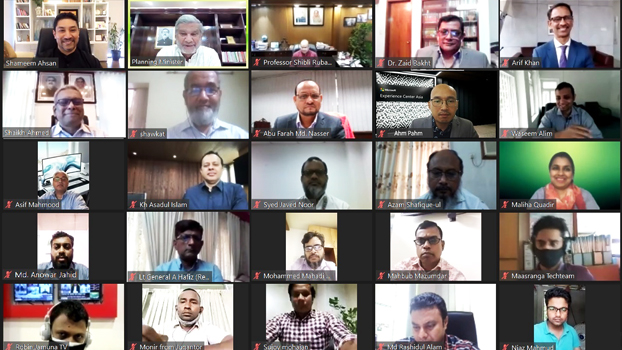

Speakers at a roundtable discussion on Thursday urged tax exemptions for alternative fund managers and called to create a fund of funds by the central bank to foster investments and better access to finance for venture capitals and startups that can help them thrive post-pandemic.

Venture Capital and Private Equity Association of Bangladesh (VCPEAB) organized the virtual roundtable session titled “Venture Capital and Startups for a Post-COVID Resilient Economy” in partnership with the Capital Market Journalists’ Forum(CMJF) in the backdrop of the national budget for the fiscal year 2021-22to be proposed this June.

Planning Minister M A Mannan attended the webinar as the chief guest, while Prof. ShibliRubayat-Ul-Islam, Chairman, Bangladesh Securities and Exchange Commission (BSEC);Prof. Dr. Shaikh Shamsuddin Ahmed, Commissioner, Bangladesh Securities and Exchange Commission (BSEC); and Abu Farah Md. Nasser, Deputy Governor, Bangladesh Bank were present as Special Guests.VCPEAB President, Shameem Ahsan chaired the session; Arif Khan, Vice Chairman, Shanta Asset Management Ltd. delivered the keynote presentation.

While addressing, M A Mannansaid, “The government is here to support the VC and startup sector, and it has taken joint efforts with regulators, private financial institutions, and venture capitalists. Together we plan to create an environment where startups can truly sustain and create an impact in our country. Moreover, we aim to work on the policy level to allow entrepreneurs to sustain and operate their businesses with ease.”

Prof. Dr. ShibliRubayat-Ul-Islam, Chairman, Bangladesh Securities and Exchange Commission (BSEC)said, “We have always been incorporating new rules and regulations to foster investments in startups and to assist in bringing startups to the capital market with proper due diligence.Startups use innovative business models to drive growth.”

Shameem Ahsan, President of VCPEAB and Chair of the session said, “In next 15 years, majority organizations in the world will initiate impact-driven businesses and the majority of the world population will consume products and services from impact-driven companies.

Prof. Dr. Shaikh Shamsuddin Ahmed, Commissioner,Bangladesh Securities and Exchange Commission (BSEC) said, “Venture capital can play a vital role to bring new startups to our economy. These startups should not be limited to only a few cities where everything is technology-driven, and where the services are only for the highly educated/privileged.”

Abu Farah Md. Nasser, Deputy Governor, Bangladesh Bank said, “Bangladesh Bank will give as much facility as possible under the current regulations. The market demand for credit is already there and the banking sector has to be efficient to be an important part of the VC and startup ecosystem.”

Arif Khan, Vice Chairman, Shanta Asset Management Ltd. said, “Today’s startups will be the building block of the next decades in Bangladesh. Appreciating the role of the Government of Bangladesh in the last five years, I would like to request all the regulators and stakeholders to remove the major obstacles as fast as possible for a robust startup ecosystem to unleash the opportunity in an undiscovered gem of Asia.”

SujoyMohajan, Business Editor, ProthomAlo, and Executive member of Capital Market Journalists’ Forum (CMJF) said, “Startups have difficulty raising capital from the local market, which points to the critical shortcomings of fund management in the country.”