Iran-Israel conflict

‘Bangladesh economy may suffer fresh blow’

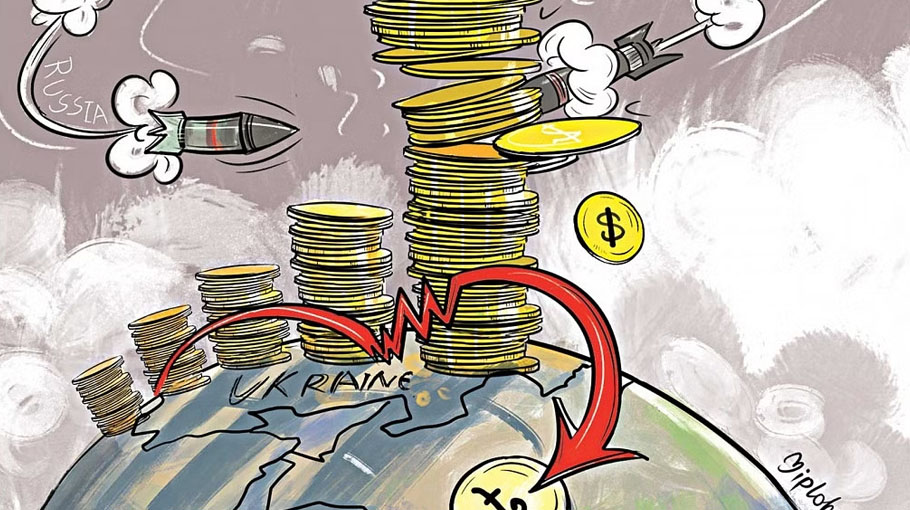

The economy of Bangladesh may suffer a fresh blow due to the growing tension created over the conflict between Iran and Israel.

Experts fear that remittance inflow from the Middle East region may drop because of the new tension created after Iran’s attack on Israel following the killing of seven Iranian Revolutionary Guards, including two senior generals.

The escalating tension over the Iran-Israel conflict has already hit the country’s capital market as share prices are witnessing continuous fall, increasing the woes of the stakeholders.

Besides, the tension may disrupt the supply chain along with increasing the cost of exporting garment products. Businesses say that if the Iran-Israel conflict escalates, it will affect Bangladesh’s garment trade.

Former BGMEA Director and Managing Director of Team Group Abdullahil Rakib told the Bangladesh Post that the Middle East crisis will certainly impact on the supply chain as the export-import process will be hampered in many ways.

“The crisis will put a negative impact on oil prices. If the OPEC countries go for non-cooperation, it will create a serious impact on prices of US Dollar. Remittance earners will face new setback and international trading market will be unstable, which will no doubt severely disrupt the export-import process worldwide,” he said.

“Although the situation has not yet taken a serious turn, there still have some reasons to be worried,” he added.

Mohammed Hatem, Executive President of BKMEA told the Bangladesh Post that investment in the country’s garment sector will be at stake if the Iran-Israel conflict continues.

“The economy of all the countries will seriously be affected if the Iran-Israel war continues. Our economy will be affected more,”

he said. Dhaka University Professor Dr Gobinda Chakraborty told the Bangladesh Post that Bangladesh has somehow been overcoming the economic shocks after the COVID-19 pandemic and ongoing Russia-Ukraine war.

Over the transporting goods amid the fresh tension, he opined that an impact may put on transporting goods due to roguery of pirates on sea routes. “The government should focus on ensuing hassle-free export,” he said.

Asked about the Iran-Israel conflict, Gobinda Chakraborty said, “The recent tension between Iran and Israel will not create a volatile situation as world players like China, Russia, USA and UK are urging both sides to show maximum restraint.”

Over the remittance inflow from Middle East, he said, “If a chaotic situation persists in the Middle East for a long time, it may put an impact on the country’s economy.”

Amid the escalating tension, CNBC, an American business news channel, on Monday reported that oil prices could surge to $100 per barrel and beyond if renewed fears of a regional war emerge.

“Any attack on oil production or export facilities in Iran would drive the price of Brent crude oil to $100, and the closure of the Strait of Hormuz would lead to prices in the $120 to $130 range,” said the report.

Late on Saturday, Iran launched a direct attack on its long-time arch foe Israel for the first time, firing a wave of more than 300 missiles and drones.

Nearly all of them were intercepted by Israel and other countries, including the United States, Jordan and Britain.

Iran said that its attack came in response to a deadly April 1 air strike on Tehran’s consulate building in the Syrian capital Damascus that was widely blamed on Israel.

That attack killed seven Iranian Revolutionary Guards, including two senior generals, and prompted Iranian threats of retaliation.

Amid the tension, both Israel and Iran also imposed restrictions on airline traffic, requiring airlines to reroute, thereby extending flight times and adding to fuel costs.